36+ Mortgage broker borrowing calculator

Use this auto loan calculator when comparing available rates to estimate what your car loan will really cost. A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages.

Fixed Vs Arm Mortgage Loans Mortgage Mortgage Infographic Mortgage Loan Originator

If you take out an adjustable-rate mortgage ARM loan remember that ARM rates are not like fixed rates.

. 80 More details. Variable 0 0. For product information.

To find out what type of gearing is best for you read this. They usually get a broker for help in finding and comparing loans. Cash-Out Refinance vs Home Equity Loan.

Which Is Best For You. The mortgages are aggregated and sold to a group of individuals a government agency or investment bank that securitizes or packages the loans together into a security that investors can buyBonds securitizing mortgages are usually. The Borrowing Power Calculator provides you with an estimate of how much you may be able to borrow for a car loan based on what you can afford to repay.

A mortgage broker is a middleman. Lenders typically say the ideal front-end ratio should be no more than 28 percent and the back-end ratio including all expenses should be 36 percent or lower. These are compared to the starting monthly payments of a 95 LTV 5 year fixed rate mortgage 305 repaid over 35 years and a 75 LTV mortgage 284 2 year fixed rate repaid over 35 years plus a 20 LTV top-up second charge mortgage 599 fixed rate for 2 years followed by 849 fixed rate for 3 years interest-only interest rates and CPIH.

Mortgage Calculator Tax Pay Calculator Personal Loan Calculator Car Loan Calculator Term Deposit Calculator. Todays national mortgage rate trends. Using the guideline that your home-related expensesshouldnt be more than 28 of your gross income you should try to keep your monthly mortgage payment including property taxes and mortgage.

Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. The rate and payment can fluctuate. Simply enter the amount you wish to borrow the length of your intended loan vehicle.

If youre in the market. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

LLC is a Marketing Lead Generator and is a Duly Licensed Mortgage Broker as required by law with its main office located at 1415 Vantage. A remortgage calculator can help you to find and compare remortgage deals. Public Sector Net Borrowing measures the difference in value between spending and income for public corporations the central government and local governments during the previous month.

See how those payments break down over your loan term with our amortization calculator. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. Lenders mortgage insurance calculator Capital gains tax calculator Extra lump sum payment calculator Mortgage repayment calculator Borrowing Power Calculator Income Tax.

When comparing loans its best to. 36 - 72 months. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors.

The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. You could potentially do all your banking and borrowing in the same place. Eligible refinancers borrowing 250000 or more can get a 3288 cashback.

Our calculator works out your loan-to-value LTV based upon your house price and how much you need to borrow. Use our free mortgage calculator to estimate your monthly mortgage payments. Find financial calculators mortgage rates mortgage lenders insurance quotes refinance information home equity loans credit reports and home finance advice.

Home Loans in the table include only products that are available for somebody borrowing 80 of the total loan amount. ZGMI is a licensed mortgage broker NMLS 1303160. Canstar will direct your enquiry to a third party mortgage broker.

One offers consumer bank accounts credit cards and other services. Once you take out a fixed-rate mortgage like a 15-year fixed or 30-year fixed rate mortgage the interest rate remains the same for the life of the loan. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination.

Second mortgages come in two main forms home equity loans and home equity lines of credit. The loan is secured on the borrowers property through a process. Terms and conditions apply.

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. When the Bank of England puts its base rate up it generally makes borrowing more expensive. If you want to use it as an interest only mortgage calculator select the interest only option for mortgage type.

Second mortgage types Lump sum. Account for interest rates and break down payments in an easy to use amortization schedule. On Monday September 12 2022 the current average 30-year fixed-mortgage rate is 608 increasing 3 basis points from a week ago.

The mortgage amortization schedule shows how much in principal and interest is paid over time. It will show you the mortgages including interest rates and product fees that are available and the total amount payable over your mortgage deal. For most homeowners that will mean your mortgage becomes more expensive - but whether you immediately feel the impact depends on the.

Please read the Calculator Assumptions and Disclaimers for more information. 0 - 0 months. If you decide to.

A Simplified Guide to Borrowing Against Your Home Equity. Results are based on a loan term of five years and assumes the interest rate does not fluctuate for said term. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property.

Financial adviser andor mortgage broker. Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages.

Printable Mortgage Calculator In Microsoft Excel Mortgage Loan Calculator Mortgage Amortization Calculator Refinancing Mortgage

19 Sample Loan Application Letters Pdf Doc Free Premium Templates

Mortgage Rates Have Never Been Lower

How Much Can I Borrow Online Mortgage Calculator Online Mortgage Mortgage Calculator Amortization Schedule

Handy Home Blog Calculating How Much You Can Afford To Spend On A Mortgage Payment Buying First Home Home Buying Tips Home Buying

2

Pretto Online Mortgage Broker Mortgage Brokers Mortgage Calculator Mortgage

Lol So True Tm Mortgage Loan Originator Underwriting Mortgage Humor

Free 3 Real Estate Loan Proposal Samples In Pdf

7 Great Referral Sources For Smart Loan Officers Mortgage Infographic Mortgage Infographic Mortgage Protection Insurance Mortgage Loan Officer

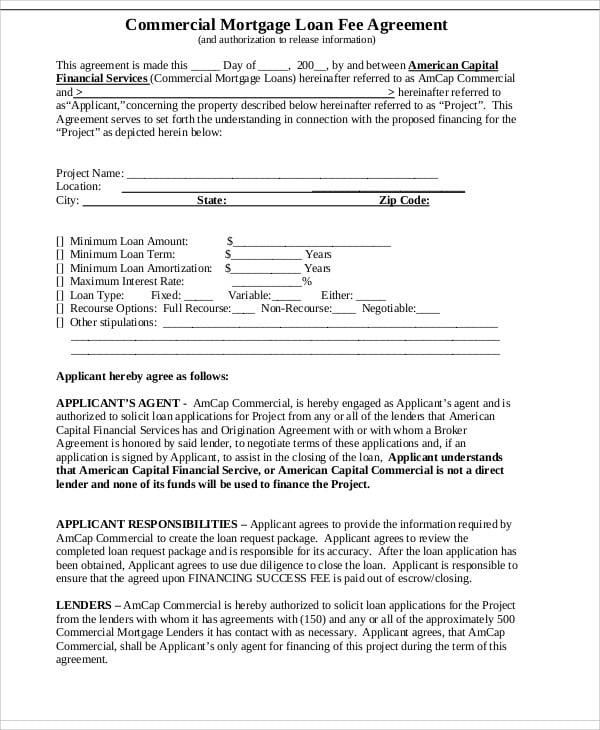

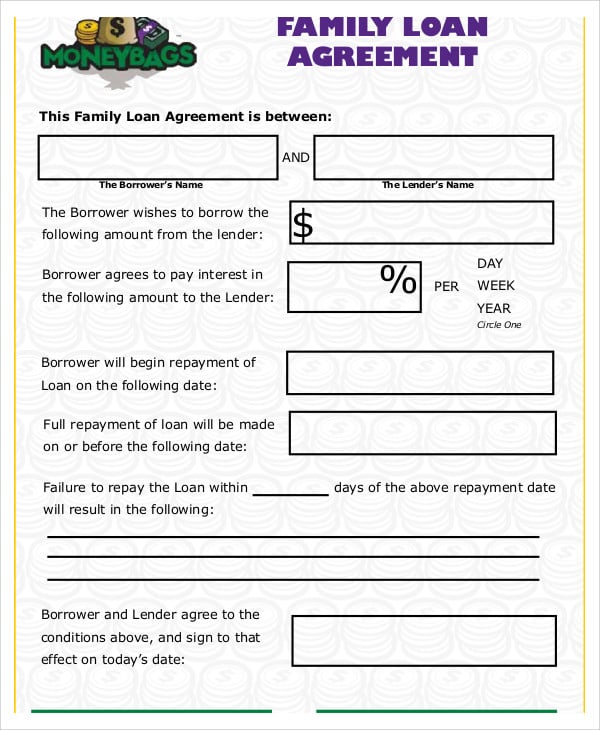

31 Loan Agreement Templates Word Pdf Pages Free Premium Templates

Home Loan Lead Generation Case Study Map Home Loans

Use The Interactive Online Emi Calculator To Calculate Your Home Loan Emi Get All Details On Inter Life Insurance Premium Life Insurance Calculator Income Tax

31 Loan Agreement Templates Word Pdf Pages Free Premium Templates

2

Home Loan Home Loans Debt Relief Programs Home Improvement Loans

31 Loan Agreement Templates Word Pdf Pages Free Premium Templates